$4B in Biotech Fundraising in January; $12B Run Rate for Q1. Biotech Moving with M&A

- Jonathan Poyer

- Feb 8, 2024

- 4 min read

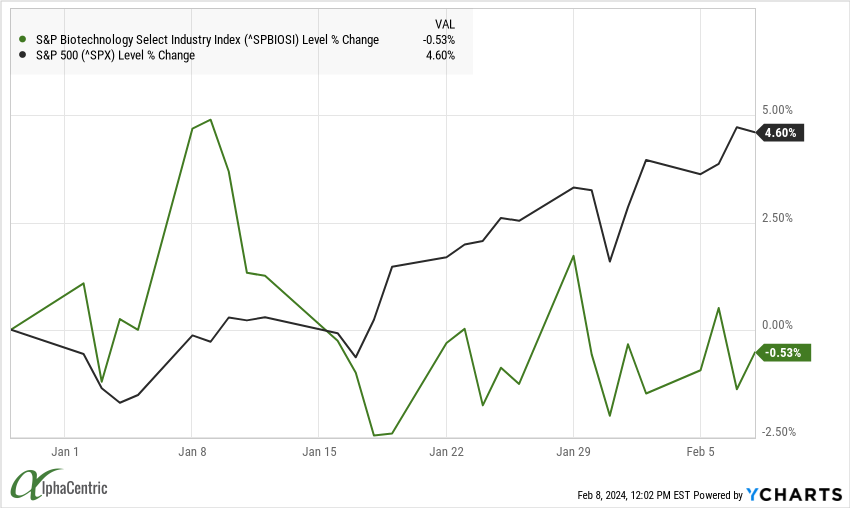

The S&P Select Biotech Index continues to consolidate above the 50-day moving average as near-term rate cut estimates dissipate.

Fed Chairman Powell's comments that March cuts are unlikely and last weeks' blowout jobs number coming in at nearly double estimates with higher wage gains pushed expectations for easing out to mid-year. Biotech fundraising activity remains brisk with over $4B raised in January, in addition to ~$800M in IPOs. This >$12B run rate for Q1 24 is ahead of the peak quarter of the last bull cycle ending in 1Q 2021. Meanwhile, market breadth remains narrow as both the S&P 500 and NASDAQ make fresh all-time record highs. Meta Platforms (META) added an exclamation point to the momentum theme with a record $197 billion single day gain in market capitalization upon announcing 4Q earnings.

M&A:

Novartis (NVS) plans to buy MorphoSys AG (MOR) for $2.9 billion, representing a ~60% premium from the closing price on February 2nd before M&A rumors were published by Reuters. The deal remains >50% below the peak share price in 2020 though and comes with controversary as lead drug pelabrasib (BET inhibitor) met the primary endpoint of spleen size reduction in the P3 MANIFEST-2 trial in myelofibrosis, but missed the key secondary endpoint of symptom reduction. Analysts had been debating the likelihood of approval given the mixed data set

Novo Holdings plans to acquire Catalent (CTLT) for $16.5 billion enterprise value or $63.50 in cash, representing a 16.5% premium over the prior days closing price. Novo Holdings will immediately sell three key CTLT fill/finish sites (Belgium, Bloomington, Anagni) to Novo Nordisk A/S (NVO) to build out diabetes/obesity GLP-1 manufacturing capabilities. Activist investor Elliott had been engaged with CTLT to explore strategic alternatives

2Seventy Bio (TSVT) sold its entire development portfolio to Regeneron (REGN) for only $5m upfront, potential approval milestones / royalties and assumption of 160 employees. Well over $1 billion had been invested in TSVT and predecessor company bluebird bio highlighting the challenges of realizing value for complex treatment modalities with high spend needed to reach approval / profitability. The remaining employees at TSVT will focus on Abecma commercialization with pro forma cash burn of $80-100M in 2024

Cytokinetics (CYTK) deal speculation hit a few bumps in the road with news CFO Ching Jaw will resign effective February 23rd citing a personal health condition and CEO share sales (part of 10 (b)5-1 filing). Specialists continue to debate whether CYTK's board might accept a bid below the $13 billion Bristol Myers (BMY) paid for competitor MyoKardia (MYOK) given the suggestion that CYTK has a superior profile

Regulatory:

CMS sent pharma companies (JNJ, MRK, PFE, BMY, AMGN, ABBV, BI, LLY, AZN and NOVO) with the first 10 drugs on the IRA list their initial price proposals. Negotiations are expected to continue until the potential take it or leave offer deadline of July 15th. Prices may be first publicly disclosed by Sept 1st with a detailed explanation by March 1 2025

FTC is challenging pharmaceutical patents listed in the Orange Book focused on delivery methods. This is the latest move by the current administration to reduce drug prices through expanding the scope of agency intervention

Clinical:

Vertex Pharmaceuticals (VRTX) reached an all-time-record high on positive primary endpoint data in the Ph3 trials for NaV1.8 inhibitor VX-548 in acute pain post abdominoplasty and bunionectomy compared to placebo. VX548 did not show superiority to active control Vicodin in either study; however, and was statistically inferior to active control Vicodin in the bunionectomy study. The stock caught a couple of downgrades as analysts debate the market opportunity, but these have not yet dented the upward momentum

Capital Markets:

IPOs roll on with Alto Neuroscience (ANRO) trading up ~35% after raising ~$130 million while Fractyl Health (GUTS), the 5th biotech IPO of 2024, traded down ~14% on its first day of its IPO

Corporate Updates and Earnings:

Pfizer (PFE) reported 2023 EPS ahead, 7% operational growth ex-COVID and n=9 NME approvals in 2023 more than any other top pharma company received in the past 3 years. 2024 guidance reaffirmed

Novartis (NVS) 2023 reported a top and bottom line miss and guided to mid single digit revenue growth in 2024. Mid term guide remains >5% CAGR 2023-2028

Novo Nordisk A/S (NVO) guided to 18-26% 2024 revenue growth vs 23% street, crossed >$500B Mcap

GSK (GSK) guides 2024 adjusted EPS up 6-9%, revenue +5-7% at constant currency. Medium term guidance for >7% sales CAGR 2021-26 (at CER, excluding COVID) vs >5% prior

Biogen (BIIB) announced the discontinuation of the Phase III confirmatory / post marketing study for Aduhelm and all commercialization efforts. BIIB will focus on Leqembi as the key Alzheimer's asset moving forward

Roche Holdings (RHHBY) reported an in line quarter and 2024 guidance for Core EPS (at CER) to increase in the mid single digit range in line with sales growth. Headwinds from the strong Swiss franc pressured pro forma projections

Sanofi (SNY) reported a Q4 miss, 2024 EPS guide for "low-single digit decline" (at CER) driven by an expected tax rate increase to 21% vs 18.8% in 2023 assuming an Fx headwind between -3.5% to -4.5%

Merck (MRK) reported a sales and EPS beat in Q4. FY24 sales guidance was in-line ($62.7B-$64.2B v $63.42B street) with adjusted gross margins ahead (80.5% v 79.4% street). 4Q beat driven by Keytruda strength at $6.6B for the quarter, +21% y/y

Bristol Myers (BMY) top and bottom line beat, guidance for revenue to "increase by low single-digits" (at CER and post FX)

Regeneron (REGN) revenue ahead and adjusted EPS was 10% higher than consensus

Abbvie (ABBV) reported Q4 EPS in line with revenue ahead. Guided for a high single-digit compound annual revenue growth rate through 2029. Expects combined Skyrizi and Rinvoq 2027 revenues of more than $27B, an increase of ~$6B compared to previous guidance

DCGO INC (DCGO) approved a new share repurchase program for up to $36M of common stock during 6-month period ending July 30th, 2024 on the heels of a short report that sent shares down ~40% YTD

Culling the Herd:

WSJ reported SoftBank-backed Invitae Corp (NVTA) is preparing for bankruptcy. Shares sold off >70% on the news

CANO Health (CANO) filed for Chapter 11 bankruptcy. Stock sold off ~62%

Reductions in force from Dermtech (DMTK, 15% RIF) and Novavax (NVAX, 12% RIF)

Comments