Continue to Keep an Eye on the VIX - A Spring Coil Loading

- Jonathan Poyer

- Sep 20, 2023

- 1 min read

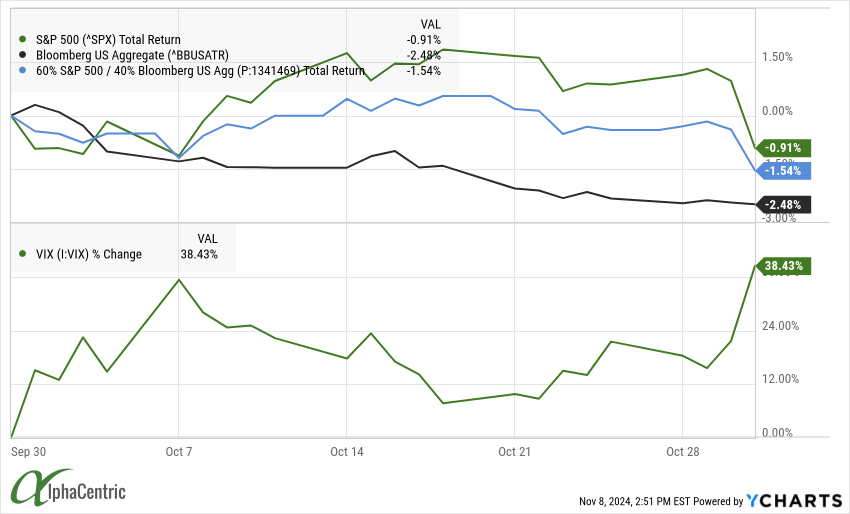

For the month of August, the S&P 500 returned -1.59% and a 60/40 (S&P 500/AGG) -1.33%. For the year, the S&P 500 is up +18.73% and the 60/40 +10.83%.

In August, global stock markets declined as longer-duration interest rates rose on expectations that the Federal Reserve will continue hiking rates aggressively to combat high inflation, as well as a rare downgrade of US Debt.

The VIX rose mid-month to its highest level since May before retreating to actually finish the month lower – despite the S&P being lower. While the S&P 500 sold off over 4.5% at one point, it recovered most losses by month-end, resulting in lower volatility than initially signaled. Despite losses, market breadth modestly improved, suggesting further gains may occur if participation broadens.

In clearer terms, the market has been moving back and forth between weak and strong stock prices, but generally decreasing volatility. In general, a rising market/falling volatility environment occurs about 65% of the time and a falling market/falling volatility environment around 5%.

We like to tilt position towards option income generation models, which look to perform during falling volatility.

We have said this before, but it seems worth repeating: the amount of short option, VIX ETF, and other volatility needing to be covered (essentially by selling stock or buying options) is at its highest level since early 2018. Pairing that with a VIX this low is like winding up a jack in the box. Eventually, all of that pent up and suppressed volatility will pop out. When, where, and by how much are the billion dollar questions.

Comments