Earnings Season Highlights a Number of Beats but Not Enough to Raise the Index

- Jonathan Poyer

- May 2, 2024

- 2 min read

Earnings season has kicked off and we have seen some strong beats thus far. Value therapeutics stocks are trading at depressed levels, but are putting up good numbers…

Let us look at a few of the highlights:

Pfizer (PFE) reported a 1Q beat on both revenue ($14.9 billion vs street $13.9 billion) and adjusted EPS ($0.82 vs street $0.51). 2024 adjusted EPS guidance was raised to $2.15-$2.35 from $2.05-$2.25. Non-Covid operating revenue grew 11% from the year earlier.

Harmony Biosciences (HRMY) reported a 1Q beat with ~30% revenue growth year on year and maintained 2024 guidance (revenue $700-720 million).

United Therapeutics (UTHR) reported a 1Q beat on both revenue ($677 vs street $624 million) and adjusted earnings ($6.17 vs street $5.78).

Some other notable stocks to highlight:

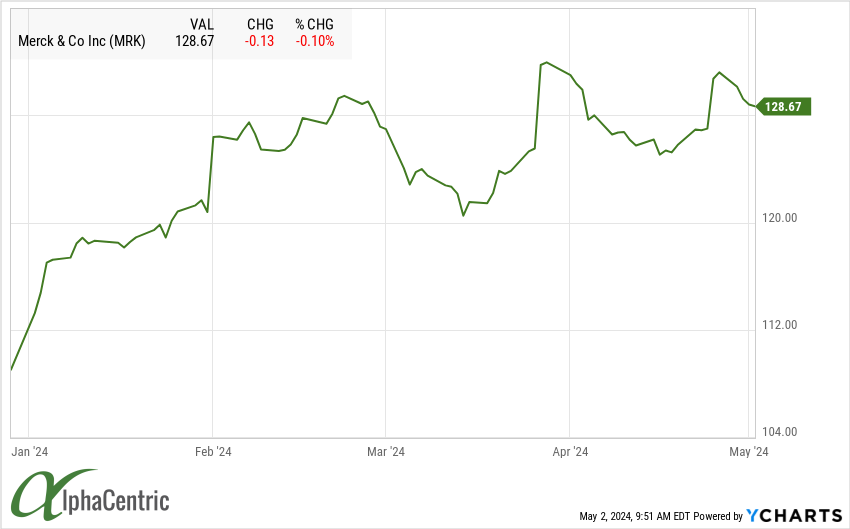

Merck (MRK) announced a 1Q beat (rev $15.75B vs street $15.2B) and raised FY guidance (Revenue $63.1B-$64.2B vs prior $62.7B-$64.2B, aEPS $8.53-$8.65 vs prior $8.44-$8.59) on strength from Keytruda (1Q $6.95B vs street $6.7B) and Lageviro (1Q $350 million vs street $150 million)

Abbvie (ABBV) reported a Q1 beat ~3% ahead of the street, but shares sold off on concerns biosimilars to Humira are gaining share (branded sales down ~40% year-on-year)

Gilead Sciences (GILD) announced a 1Q revenue beat ~5% ahead of the street with EPS negative due to the Cymabay acquisition

BioMarin (BMRN) 1Q revenue was ~1% below consensus, but adj EPS beat ($0.71 vs street $0.62). 2024 revenue guidance was maintained with EPR increasing to $2.75-$2.95 vs prior $2.60-$2.80 due to cost cuts. Voxzogo contributed $153 million (+5% Q/Q) and Roctavian generating only $0.8 million

Bristol Myers (BMY) reported results ahead of consensus driven by slower than expected erosion of Revlimid to generics. Key franchises Opdivo, Camzyos and Sotyktu all came in light. 6% workforce reduction announced

Novartis (NVS) reported a Q1 beat and raise. Net sales (CER) updated to grow "high-single to low-double digit" versus prior "mid single digit" driven by Entresto/Cosentyx strength

Biogen (BIIB) reported 1Q earnings ahead of street estimates ($2.67 vs $3.54 street) with revenue down 7% from the prior year period. Alzheimer's drug Leqembi revenue was $19 million (missed $30 million street) with an uptick seen in March. 2024 guidance of low- to mid-single digit percentage decline in total revenue and ~5% income growth on lower expenses was reaffirmed

Comments