Novo Nordisk Meets with the Senate Under Pressure to Reduce Prices as Biotech Takes a Breather After Rate Cuts

- Jonathan Poyer

- Sep 24, 2024

- 3 min read

Biotech took a breather to start the week following a retest of the 2024 highs following the Fed's more aggressive 50 bp rate cut last week. M&A remains quiet but is expected to pick up into year-end after the election.

Strategists have been calling for a broader rotation into equities given record money market fund balances of >$6.3 trillion. Relative positioning for biotech is expected to improve with another 50 bps of rate cuts expected in 2024 and 100 bps+ in 2025.

M&A:

Organon (OGN) announced the acquisition of Dermavant including psoriasis therapy Vtama for up to $1.2 billion plus royalties. Roivant (ROIV) is the parent company of Dermavant and will receive $175 million upfront, $75 million upon label expansion of Vtama in AD, additional payments of up to $950 million in commercial milestones and tiered royalties on net sales.

Revance Therapeutics (RVNC) disclosed notice to remedy alleged material breach of distribution agreement with dermal filler partner Teoxane and extends pending tender offer for planned acquisition from Crown Laboratories. The timing of the complaint form Teoxane is notable given the proximity to the merger.

Regulatory:

The 5th Circuit Court of Appeals reversed the dismissal order from the district court earlier this year that will allow PhRMA's litigation regarding price controls in the IRA to proceed.

Novo Nordisk (NVO) was under pressure after comments that diabetes and obesity flagship Ozempic could be targeted for next round of IRA related price controls. Bernie Sanders has been calling out generics to offer Ozempic for less than $100 per month compared to >$1,000 for the brand. Recall Novo mgmt will appear in front of a Senate HELP committee meeting on Sept 24

Apellis Pharmaceuticals (APLS) announced he Committee for Medicinal Products for Human Use (CHMP) of the European Medicines Agency (EMA) has confirmed its June 2024 negative opinion toward the marketing authorization application (MAA) of intravitreal pegcetacoplan for treatment of geographic atrophy (GA).

Vanda Pharmaceuticals (VNDA) announced FDA declined to approve Tradipitant for gastroparesis and requested additional studies before a potential future approval.

Applied Therapeutics (APLT) announced FDA no longer intends to hold an advisory committee for govorestat in classic galactosemia. The PDUFA date remains 11/28.

The Creating Hope Reauthorization Act of 2024 (H.R. 7384) which would renew the Rare Pediatric Disease Priority Review Voucher (PRV) program for another five years may or may not advance. Without program renewal, FDA will no longer be able to initiate the process necessary to issue rare pediatric disease PRVs, and only those programs that have been granted the designation prior to September 30, 2024, and are approved prior to September 30, 2026, will be eligible to receive a PRV.

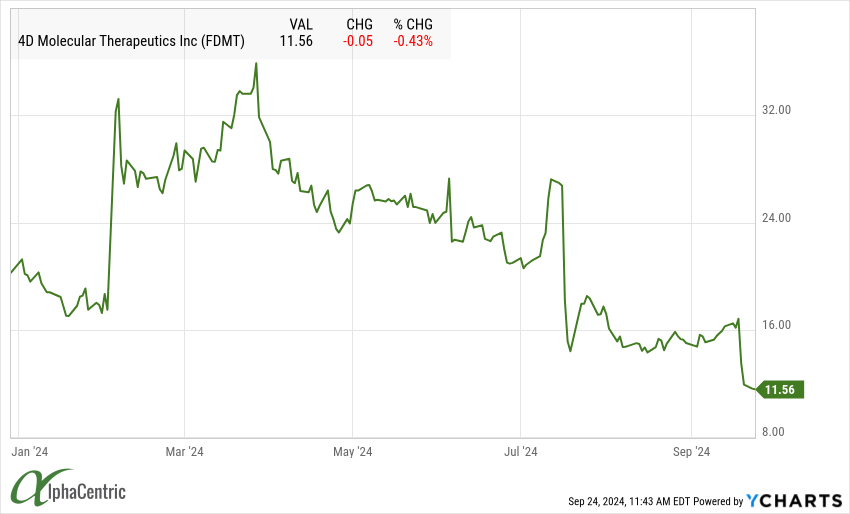

4D Molecular Therapeutics (FDMT) shares were down >25% on a mixed data update and plans for phase 3 pivotal trials that left analysts questing the overall drug profile and commercial opportunity.

Clinical:

Biohaven Pharmaceuticals (BHVN) made an unusual move by claiming victory from a previously failed trail by throwing out the initial control arm and instead 'matching' patients to an external historical data set over a longer treatment interval that extended beyond the initial trial design. BHVN tried this approach previously with an earlier cut of data and FDA responded with a refusal to file letter given the trial failed to meet the primary endpoint. The company's claims the new BHV-4157 (troriluzole) data analysis in Spinocerebellar Ataxia (SCA) now contains more patients and input from FDA. BHVN plans to re-file for approval later this year.

Ideaya Biosciences (IDYA) announced positive interim Phase 2 data for darovasertib in neoadjuvant uveal melanoma that showed 49% eye preservation in all patients and 61% in enucleation patients. FDA agreed for a pivotal trial of n=400 patients with a primary endpoint of eye preservation for the enucleation cohort and time to vision loss for the plaque brachytx cohort. IDYA projects ~1 year for enrollment and an additional ~2 years to get to the primary endpoint.

Corbus Pharmaceuticals (CRBP) fell >50% on a data release from competitor Novo Nordisk (NVO) that CB1 weight loss program showed weight loss at the lower-end of expectations of ~6%. More concerning was disclosure of mild to moderate neuropsychiatric side effects, primarily anxiety, irritability, and sleep disturbances, that were more frequent and dose dependent with monlunabant compared to placebo. Analysts believe the safety profile for CRBP and NVO second generation peripherally restricted CB1s must be clean given prior market withdrawal of first generation CB1 Rimonabant.

Edgewise Therapeutics (EWTX) released Ph 1 single dose data for its sarcomere modulator in cardiomyopathy that showed a reduction in LVOT-G without meaningful excursions in LVEF.

Corporate Updates and Earnings:

Progyny Inc (PGNY) shares were under pressure after announcing their largest client (rumored to be Amazon) will terminate the existing services agreement by year end. The contract comprised 13% of revenue and a smaller percentage of EBITDA over the past year.

Comments