The VIX Floor Keeps Moving from Under our Feet. Is That a Good Sign for Things to Come?

- Jonathan Poyer

- Jan 29, 2024

- 1 min read

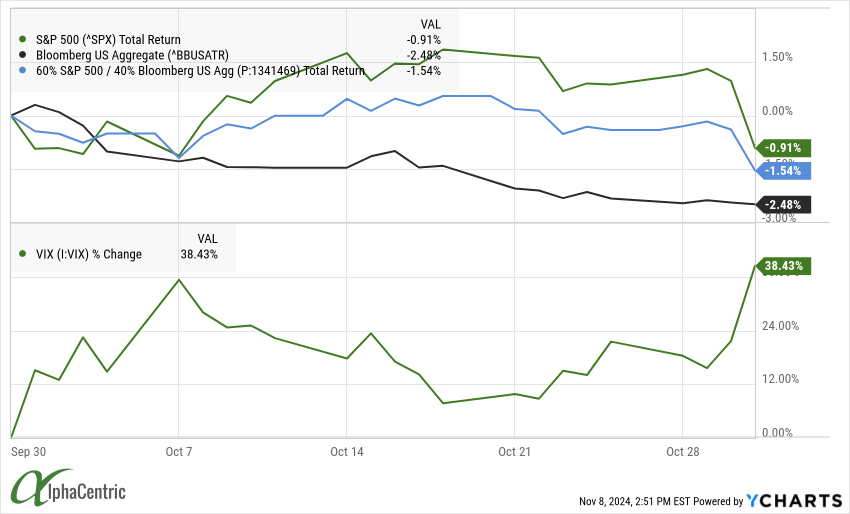

4th quarter returns for the S&P 500 seemed to erase the memory of many investors as to the swings throughout the rest of the year. Q4 started slowly with US stocks falling for a third month in a row being down -3.49% as late as October 27th. And then all became well in the world (for US stock investors), as market rallied, climbing more than 15% during nine consecutive up weeks to close the year up 26.2%.

Looking out into the year ahead, it looks like a reset and start of a new market regime that we believe could last multiple years. Markets are essentially a neutral stance, or at close to all-time highs, but with valuations (Shiller CAPE Ratio) about midway between 2020 lows and 2021 highs.

Volatility has erased the echo of the COVID spike and become much more of a two-way environment with volatility sellers and volatility downside reintroduced to the market. The up move in the S&P at the end of the year drove volatility pricing to new multi-year lows, with the VIX closing at its lowest levels since COVID, falling 9 points in Q4 to end the year at 12.44 and further confirming the lack of a VIX floor, as we have mentioned a few times in the past.

We feel that bond/interest rate markets look set to normalize, with potential delays in easing, but the likelihood of further hikes much diminished.

It is an exciting time to be involved in the markets.

Comments